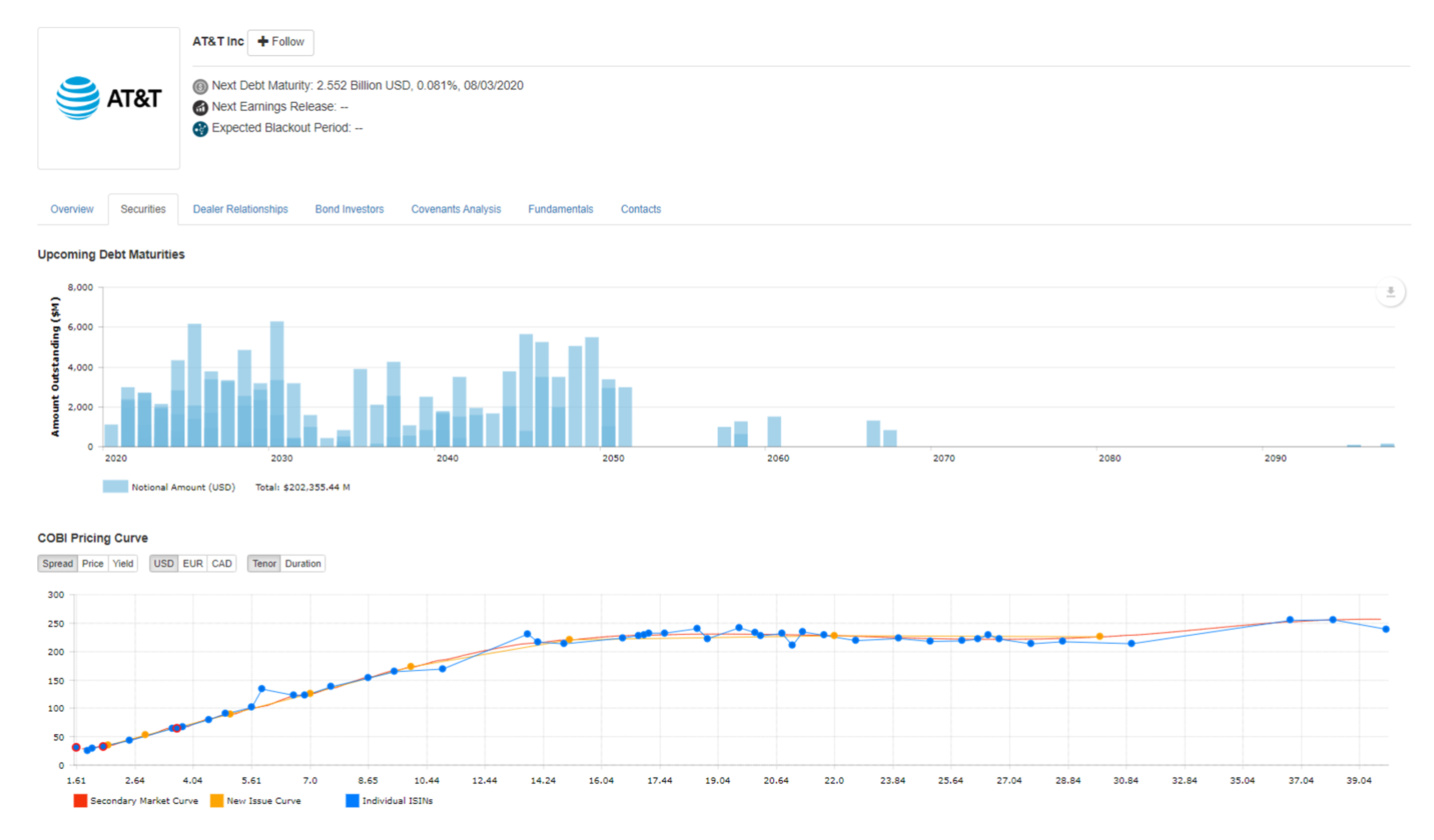

Best executable AI pricing was created as part of Overbond’s suite of predictive algorithms for the fixed income capital markets. It algorithmically predicts the most optimal indicative new issue bond price as well as relative value secondary market best-execution bond price for global IG and HY issuers, utilizing machine- learning (ML) algorithms. The ML algorithms analyze millions of data points related to factors such as secondary levels, recent indicative new issue price quotations, company fundamental data elements, investor sentiment and sector comparables.

COBI Pricing White Paper

Overbond’s Primary Fixed Income Pricing model, COBI-Pricing, delivers on Price Discovery with competitive indicative new issue pricing. Clients can arrive at accurate indicative new issue pricing levels for issuers with only a fraction of the time and manual work required.

An adaptive, real-time liquidity score is vital for today's risk mitigation measures on the trading floor. Overbond provides a live intraday Liquidity Score on individual bonds that you can use to assess secondary market tradability on any ISIN/CUSIP at any time. Utilize it for pre-trade decision-making or to assess hedging options for credit market-makers.

Liquidity Scoring AI Model White Paper

Read our Liquidity Scoring AI Model white paper that discloses model functioning, data intake and most relevant use cases.

Overbond’s AI RFQ automation uses prices and liquidity scores generated for more than 100,000 fixed income instruments, refreshed every three seconds to enable bond trading desks to fully automate 30% of RFQs and execute an additional 20% with trader supervision. Facilitated by the speed of cloud computing, interoperability with other systems and the precision of AI, the models can be trained to customize pricing based on the desk's trading style and client risk preferences.

RFQ Automation Read More

Read our Interoperability Case Study to learn how Overbond's COBI-Pricing LIVE AI model uses interoperability for RFQ automation.

Overbond execution management system (EMS) interoperability is an application that displays real-time market data and analytics and is used by traders to transact orders automatically. Overbond EMS allows traders fast, seamless execution with any counterparty or venue on the street. Overbond EMS supports low-latency electronic and algorithmic trading and provides pre-trade tools to maximise automation in any market risk environment. EMS allows traders to work the order using a variety of suitable automation protocols and order types, including smart order routing (SOR), auto-RFQ, and one-touch adjustment

EMS Interoperability Read More

Read our Interoperability case study to learn more about Overbond's EMS Interoperability.

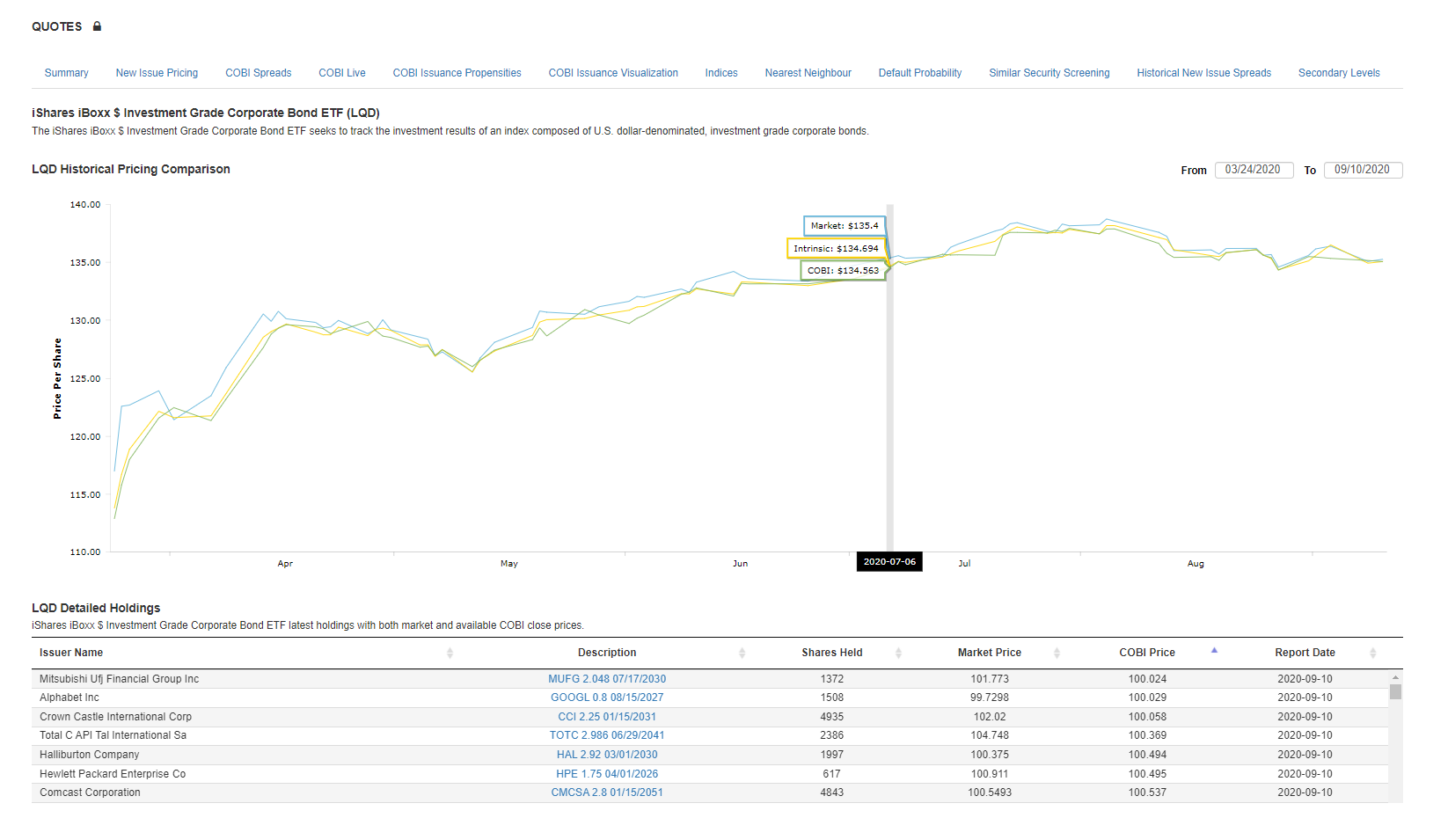

Create customized portfolios to evaluate overall liquidity and fair value pricing. You also have the ability to replicate ETFs for live pricing or produce optimal baskets for portfolio trading based on liquidity or sector diversification criteria. What’s more, you can simulate intraday ETF fair value through pricing of individual constituent bonds and strike end of day

ETF Basket Pricing Try Now

Request demo for Overbond custom portfolio building feature, liquidity scoring of all portfolio holdings and ETF pricing tool.

Margin optimization minimizes the distance-to-cover at the point of execution of all new RFQs. Overbond’s margin optimization model captures various margin optimization measures and converts them to one unified all-optimized distance. It can be trained to the risk tolerance and execution style of the desk and helps sell-side traders optimize their hit ratio and increase profit.

Margin Optimization Read More

Read our Margin Optimization AI white paper to learn how Overbond's Cobi Pricing model incorporates margin optimization to increase trading profit.